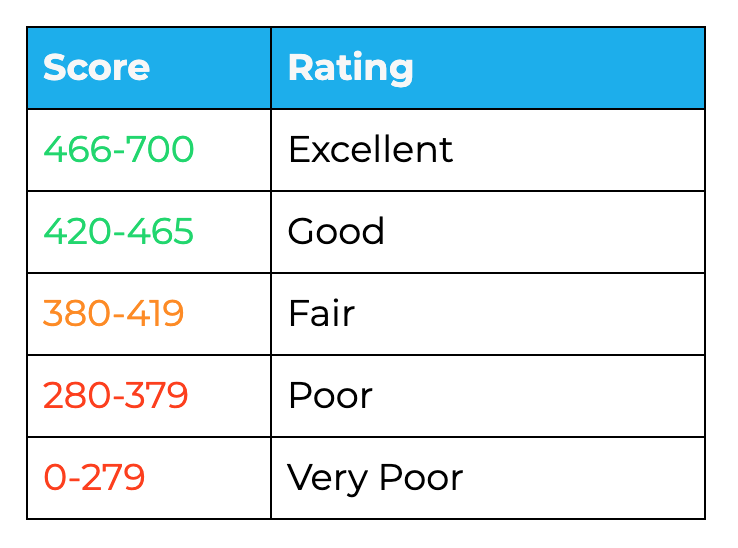

This calculation - also known as your credit utilization rate or your debt-to-credit ratio - is another important factor to lenders. It also provides data on missed or late payments, bankruptcy filings and debt collection. Your payment history includes information on any open credit accounts in your name. This is typically the most significant factor used in calculating your credit score. However, most credit scoring models consider the same factors: Your credit scores may vary depending on the scoring model used to calculate them as well as the information on the respective credit report. Like your credit score, you have more than one credit report. Your credit scores are calculated based on the information included in your credit reports. A mortgage lender, on the other hand, might use a formula to determine your risk as a mortgage borrower.Īll of these factors can lead to differences in your credit scores. If you’re in the market for a new car, for example, an auto lender might use a credit score that places emphasis on your history of paying auto loans. It’s also possible for your credit scores to vary by industry. Some may report information to only two, one or none at all. Your credit scores may vary depending on the consumer reporting agency (CRA) providing the score, the credit report on which the score is based and the scoring model.Ĭredit scores provided by the three nationwide CRAs - Equifax ®, TransUnion ® and Experian ® - may also vary because your lenders may report information differently to each. In reality, there are many different credit scores and credit scoring models. It’s a common misconception that you have only one credit score. However, higher scores typically suggest that you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a new request for credit. There’s no “magic number” that guarantees you’ll be approved for a new credit account or receive a particular interest rate from a lender. What is considered a good credit score?Ĭredit score ranges and what they mean will vary based on the scoring model used to calculate them, but they are generally similar to the following:

Your credit scores may also impact the interest rate and other terms on any loan or other credit account for which you qualify. Creditors and lenders consider your credit scores as one factor when deciding whether to approve you for a new account.

0 kommentar(er)

0 kommentar(er)